Employers will give you better salary packages if they can see how you add value to their business.

The best way to demonstrate this throughout your career is by increasing the profit or wealth within the business. In this post, we will show you how you can improve your career earnings by using the financial skills that you will learn on Hult’s programs to increase your employer’s and your personal wealth over the course of your career.

What you will learn.

- Why it is important to use your financial skills to increase profit margins.

- Why it is important to use your financial skills to create and retain asset wealth.

- Why it is important to use your financial skills to minimize a business’s exposure to financial risk.

Managerial accounting.

If you see yourself becoming a business leader, then you must develop the skills that will allow you to plan, track the performance, and make decisions from financial reports that will enable the business to achieve its goals.

Whether you become a business manager, owner, or entrepreneur, understanding the financial impact from your managerial decisions is essential for succeeding in business. Throughout your career, you will face challenges where you will need to restructure the business’s activities and operations in order to accelerate growth, free up capital, or ensure the business’s survival.

There are several key areas that you must familiarize yourself with:

Budgeting and cost allocation.

You will face several business challenges that will require you to establish a set of goals and allocate resources in order to accomplish those goals. Get it right and the business will reap profitable rewards. Get it wrong and you could make the business incur significant costs that could stagnate growth or expose the business to financial risk.

You will need to decide how to spend your own or other people’s money that is invested in the business and turn it into a profit. Some examples of budgeting expenses include:

- Budgeting and forecasting the productivity of staff.

- Productivity of equipment or software.

- Research and development

- Capital requirements

- Operating expenses

- Managing sales income.

Ways you can apply your financial management skills to distribute the business’s financial and capital resources to create a profit include:

- Hiring new staff to create a set of skills that can be sold by the business.

- Purchasing software that will reduce the amount of hours to complete a task.

- Researching and developing a product that will create a new stream of revenue in the future. (E.g. Apple’s iPhone had 5 years development before it was launched)

- Minimising staff costs with salary or staff cuts.

- Investing in technology or partnerships that will minimise operating expenses. (Such as LED lights, which will reduce lighting overhead expenses by 50%)

- Minimizing travel expenses (Taxi, air fares, meals, lodging)

Managing a well-planned budget will position the business to operate at a positive cash flow.

You must learn the methods that will allow you to plan the business’s budget effectively to minimise costs and expand its profit margin.

Financial risk management

Billionaire businessman Sir Richard Branson told Tony Robbins in Marketwatch, “The goal is to find a big upside that involves taking as little risk as possible.” Financial risk management skills will empower you to balance risk and reward, which is often the driving force between a business successfully thriving or being put in the position where they need to survive.

Businesses are always in a position where they are exposed to risk, be it currency fluctuations, funding, price movements, interest rate rises, liquidity, operational and credit risk. Therefore, financial risk management strategies are needed to curb the level of risk that will allow the business’s stakeholders to make financial management decisions confidently to promote the growth of the business.

You will need to apply strategies that you have learned to spread the financial risk from the business, while ensuring that the business maintains its position to profit from the activity. Some of these strategies may entail the following.

Funding.

There are several financial instruments that businesses can use to spread their financial risk when it comes to funding. Typically, business owners will take on 100% of the risk by owning a business outright. However, the risk can be spread by either getting more partners or inviting shareholders to invest in the business to spread the risk.

Some of the financial instruments that can implemented to protect the business against risk include the following.

Shares.

An investor can contribute funds by purchasing ownership in a business along with other shareholders in exchange for a share of the business’s profits (dividends) and for future capital gains (equity).

This allows the business to raise the necessary funds to operate and grow the business, while shifting the financial risk to the shareholders. Should the valuation of the business decrease (such as a drop in the share price), the business experiences a loss in profits or the business goes bankrupt; the shareholders absorb the losses.

Additionally, share ownership can also be used as an incentive to attract talented employees and improve productivity by issuing them with shares that will allow them to receive a percentage of profits as a result of their productivity.

Bonds.

The simplest way to think of bonds is that they are a form of an IOU. These written declarations are used to unconditionally pay a certain amount of money at a given time in accordance with the stated terms.

Interest on the bonds is either fixed or variable and is always determined in advance and is paid at an agreed interval between the issuer and the purchaser of the bond. Businesses will use bonds as a way to raise funds to invest in business activities. When the bonds mature, the payment should be returned in full with interest.

For example, the business could issue a $10,000 bond, which has a fixed interest rate of 5% over ten years. The holder of the bond will receive $500 every year for ten years and when the bond matures, they will get their $10,000 back.

You can use your financial skills to forecast the profit margin and revenue growth if the business gained an injection of cash through bonds. For example, if the business runs at a 40% profit, the business can trade 5% in exchange for a 35% profits from a higher volume of sales. This means the business could expand quicker and gain more revenue over the long-term.

The financial risk shifts to the purchaser while the business maintains a position to profit. Purchasers will lose their money if:

- The business is unable to repay the bonds.

- The interest rate declines and reduces the value of the bonds.

- Thee issuer of the bonds can recall the bonds before maturity, which can affect the expectation of the yield. This occurs when interest rates drop to lower levels.

Derivatives.

There are several types of derivatives such as options, contracts for future differences and swaps that can be used as financial instruments to raise funds and minimize risk against variables such as currency fluctuations, interest rate, commodities, or share price rises.

Derivatives are useful for a number of reasons.

Protection against pricing changes.

They can be used to purchase items for a fixed price over a certain period of time. For example, if a business purchases oil at $40 a barrel and the price increases to $50 a barrel, they will have to incur the cost. However, if they protect their purchase with a 12-month derivative agreement that allows them to purchase oil barrels at $40, they will gain more profit and also be more competitive with their prices in the marketplace.

Additionally, derivatives can be applied to protect any of the business’s transactions between different currencies from exposure to losses as a result of any currency fluctuations.

Use derivatives to free up capital and increase productivity.

In some cases, derivatives are also used in salary packages, which frees up cash within the business since it is used as a delayed payment mechanism for employees. For example, an employee that wants a cash salary of $100,000 a year could trade $30,000 for shares and options in the hope that they will profit from the rise in the share’s equity value. This reduces the business’s labour cost by $30,000 and the share price is paid by a future buyer. Additionally, the employee absorbs the risk.

Tax planning.

All businesses must pay taxes on their profits in accordance with the national taxation laws of the country where they conduct business. Businesses want to minimize the amount of tax that they pay so they can retain more cash and wealth within the business.

There is often a fine line between tax avoidance (which is legal) and tax evasion (which is illegal). Businesses found to be participating in tax evasion schemes can face steep penalties that could result in legal action against the business or the imprisonment of directors and staff.

By using your tax planning skills, you can help the business minimize their tax legally and retain more cash for growth.

This can be achieved by taking advantage of the country’s taxation system to minimise the amount of tax that needs to be paid.

Taking advantage of differences in taxation systems.

Businesses can lower the amount of tax that they need to pay by creating a favourable business structure. Businesses that generate a small business income might operate under a small business, which might give them tax breaks such as splitting the income and asset depreciation. Then there could be other structures such as companies or trusts that are more complex, but provides more tax benefits.

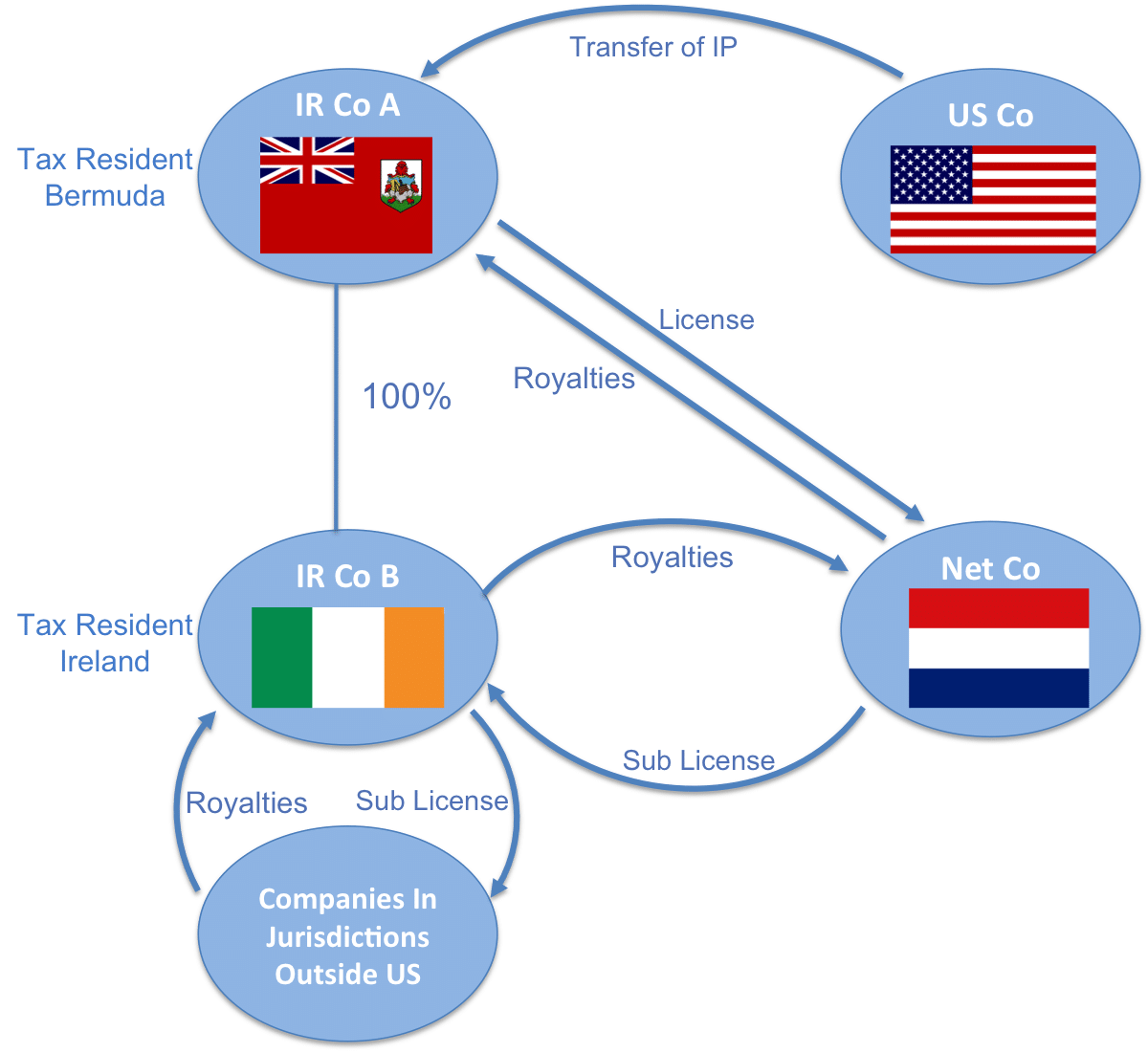

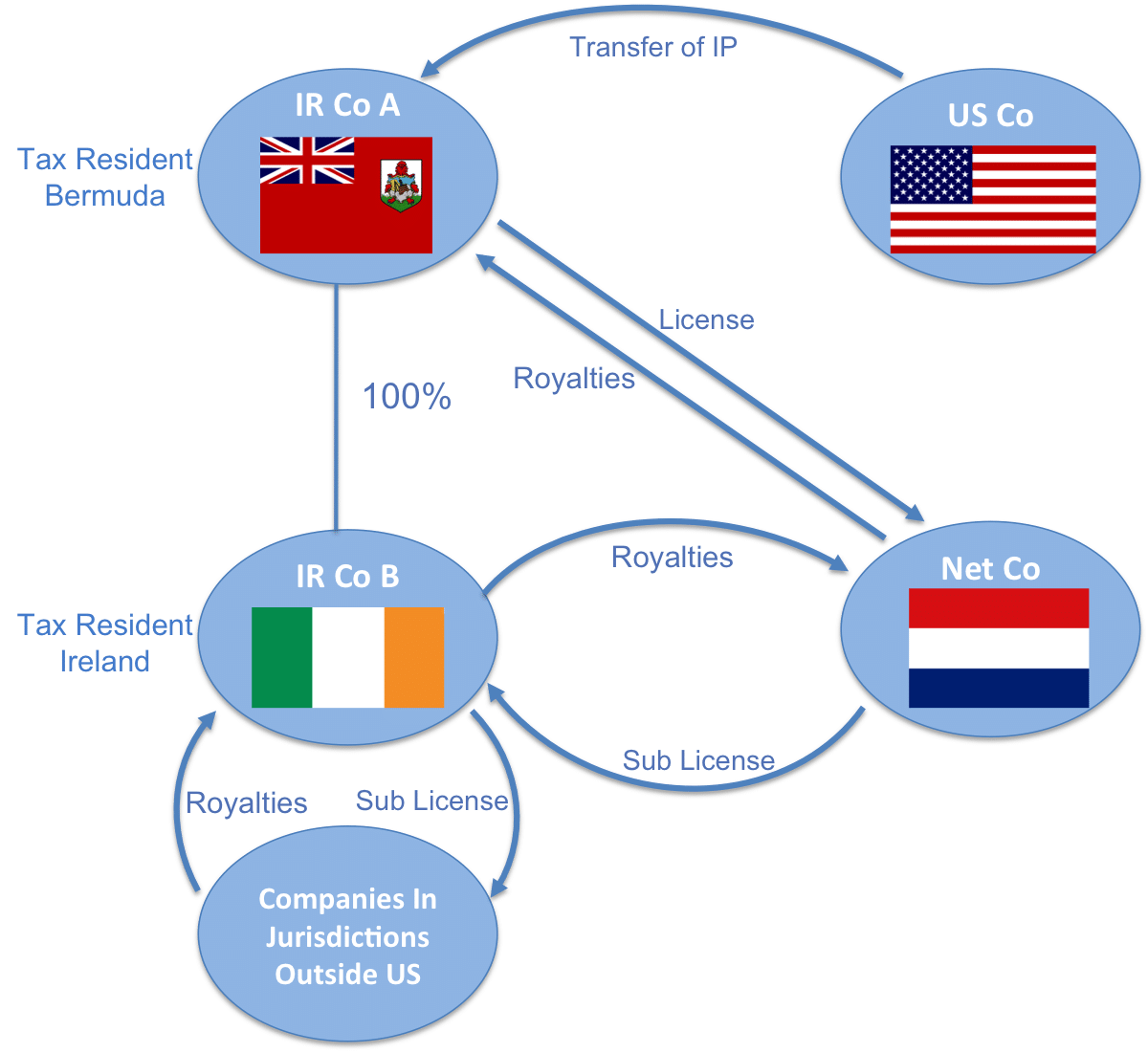

However, if businesses are paying high levels of tax in their respective countries, they can take advantage of international tax systems by structuring their business in a way that minimizes the amount tax that they need to pay to the taxation office in the country where the business operates.

Financial systems that involve the use of tax havens, double taxation agreements, royalty and licensing fee schemes, and business structures are just a few of the ways businesses can minimize their taxes.

The Motley Fool published, “10 best tax havens in the world”, which summarizes popular tax havens and highlights how companies such as Amazon Pepsi, Google and, Apple structure their companies to take advantage of these tax havens.

In the case of Apple, a post from CNBC highlights how the multinational company uses subsidiaries to minimize the amount of tax that it pays in each country. In Europe, Apple uses two subsidiary entities that are based in Ireland. Registered under the names Apple Sales International and Apple Operations Europe, both companies license IP to other Apple subsidiaries and earn an income from those licensing arrangements.

For example, if an iPhone is sold by an Apple subsidiary in China, the Chinese subsidiary must pay fees to the Irish company for the use of its intellectual property. This results in the profit from the Chinese subsidiary being shifted to the Irish subsidiary. Fortune then describes how the profits are then taxed at the Irish preferential rate, which is less than 1%, and the remaining funds are then sent through the Netherlands to be held in a tax-free haven. This scheme is known as a “Double Irish with a Dutch Sandwich”.

An illustrative example of the structure is below.

Source: Pearce Trust

Taking advantage of tax deferment.

Another way businesses can free up cash is by deferring tax. The specifics of what can and cannot be done differ among countries. In cases where a business sets up an offshore company, the business might be allowed to defer tax payments that will accumulate interest over time. However, the tax only needs to be paid once the company is sold. This allows the business to free up cash that can be reinvested to spur future growth.

Additionally, businesses can use other tax deference methods such as, “accelerated depreciation”, where the depreciation value of an asset is offset against the business’s profits. For example, machinery that has been purchased by the business at a cost of $100,000 might have a depreciation value of $10,000 per year. This depreciation cost could be split over the machine’s lifespan of ten years, effectively reducing the business’s taxable profits by $10,000. In some cases, the depreciation value can be brought forward to offset larger amounts.

How can these skills increase your career earnings?

The skills that have been highlighted should have illustrated how you can demonstrate value to the business by applying your financial skills. You can present the amount of savings, additional income or wealth that will be created as a result of applying your financial skills. For example, if you can demonstrate that your skills add $2,000,000 in additional profit per year, you can negotiate a your salary package to be 10% of that amount. The more money you make for the business, the more you will increase your earning potential.

The financial skills that are offered by Hult’s degrees can have a profound effect on your career opportunities and quality of life. Click here to view the curriculum for Hult’s Masters of Finance or click the button below to request a brochure.

If you would like to find out more about Hult’s global business programs, download a brochure here.

Accelerate your financial career and boost your earning potential with a Masters in Finance from Hult. To learn more, take a look at our blog 7 steps to working out what you want and how to get it, or get into wider business with a Masters in International Business instead. Download a brochure or get in touch today to find out how Hult can help you to explore everything about the business world, the future, and yourself.