Finance is an ever-evolving field that offers a vast array of career opportunities for those interested in pursuing a degree where numbers take center stage. Whether you are interested in the stock market, accounting, or personal finance—a degree in finance can provide you with a solid foundation to build a career. In this article, we’ll explore the purpose of finance, the differences between private equity and investment banking, the skills you’ll gain with a finance degree, and the various programs available for studying in this field. Let’s jump in.

What’s finance for?

The purpose of finance is to manage financial resources and maximize their value over time. If you’re a numbers-driven, decisive individual you might be best suited to helping organizations achieve their financial goals. That said, working in “finance” isn’t so straightforward. There are a number of fields you could specialize in like investment management, risk management, financial planning, and financial analysis and each has its own unique tasks and skillsets.

Investment management involves the management of investment portfolios, including stocks, bonds, and other securities, to generate maximum returns for investors. Risk management, on the other hand, is more about identifying and managing financial risks to minimize potential losses. Then you have financial planning— where you get to help individuals and organizations plan for their financial future. Lastly, financial analysis, which requires the examination of statements and other financials. These are just four of the potential avenues you could specialize in with a career in finance.

A closer look into Private Equity vs Investment Banking

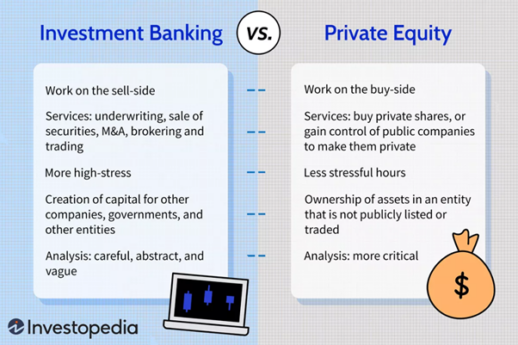

Private equity and investment banking firms both exist in the world of finance and are both used by organizations to raise funds. Despite having broadly similar end goals, the way a private equity firm would approach their task is distinctly different from the way an investment banker would.

Private equity is essentially an investment tactic. Whether it’s investing in private companies or taking a stake in public ones, it’s the job of private equity professionals to improve the performance of these companies. They raise funds for their companies through external investors. As a private equity professional, you’d take on a business operations role directly in the company you’re investing in to oversee operational changes. The goal is to raise the valuation of the company, and ultimately sell it.

In contrast, investment banking is more hands-off. Instead of having a direct role in the operational side of things like private equity, investment bankers tend to act as financial advisors, helping businesses acquire capital through deal-making. Also unique to investment banking is the relationship with both the private and public spheres. Investment bankers might help a private business go public or vice versa. Investment banking is about the needs of the client and can act as an intermediary in deals like mergers, acquisitions, and plenty of other financial transactions.

Skills required by accountants

- Attention to detail. Accountants need to be detail oriented as they are responsible for accurately recording and classifying financial transactions.

- Analytical skills. Strong analytical skills are a must as interpreting financial data and making informed decisions can’t be done without them.

- Organizational skills. Responsible for managing large amounts of financial data, accountants must ensure that it’s organized and easily accessible.

- Communication skills. Numbers aren’t everything— accountants must communicate financial information effectively to stakeholders, including executives and clients.

- Technical expertise. Accountants must be familiar with accounting software and other tools used in the field, including spreadsheets, databases, and financial management systems.

Skills required by finance professionals

- Strategic thinking. Finance professionals need to be able to think strategically and make decisions that align with the organization’s overall goals.

- Analytical skills. Just like their colleagues in the accounting department, financial professionals must be able to analyze data.

- Communication skills. Again communication skills are a top priority as they’ll be communicating big numbers to professionals less versed in them.

- Leadership skills. Finance professionals often lead teams and must be able to motivate and manage employees effectively.

- Risk management: The big one—finance professionals need to be able to identify and manage financial risks to ensure that the organization’s financial resources are used effectively.

What skills will I learn with a degree in finance?

Earning a degree in finance can provide a range of skills and knowledge highly valued by employers across multiple industries. Although skills range by degree level, some can be developed across the board at varying levels. Here are some of the key skills you’ll learn whether you choose a bachelor’s, a master’s, or an MBA.

Financial analysis

One of the primary skills that you’ll develop through a finance degree is the ability to analyze financial data. This data will come in a number of different forms. These include financial statements, cash flow statements, balance sheets, and income statements. Also on the agenda will be how to use financial ratios and other metrics to assess the financial health and performance of a business.

Risk management

As a finance professional, you will be responsible for managing risk in various financial scenarios. Through your degree program, you will learn about risk assessment, hedging strategies, and how to make informed decisions to minimize risk.

Investment management

Finance professionals often work with investments, and a degree in finance can prepare you to manage these investments. You can do this for individuals or organizations or other external clients. To get there you’ll have to learn about complex investment vehicles. These could be stocks, bonds, or mutual funds, and each has its own unique risks that you’ll have to learn about too.

Business Strategy

You won’t be an island as a finance professional. Within a business, you’ll be expected to have contact with multiple other departments. A degree in finance can provide you with a broader understanding of business strategy and operations. You will learn about business planning, financial forecasting, and how to use financial data to help the business develop.

Communication

Finance professionals need to be able to communicate complex financial concepts and data to others in ways they can articulate them to clients. A finance degree program can help you develop effective communication skills, including the ability to present financial data in a clear and concise manner.

Technology

Finance professionals rely heavily on technology to manage their decision-making. Familiarity with business intelligence tools and data management software is becoming more valuable in the modern age. A degree in finance will help you master some of these.

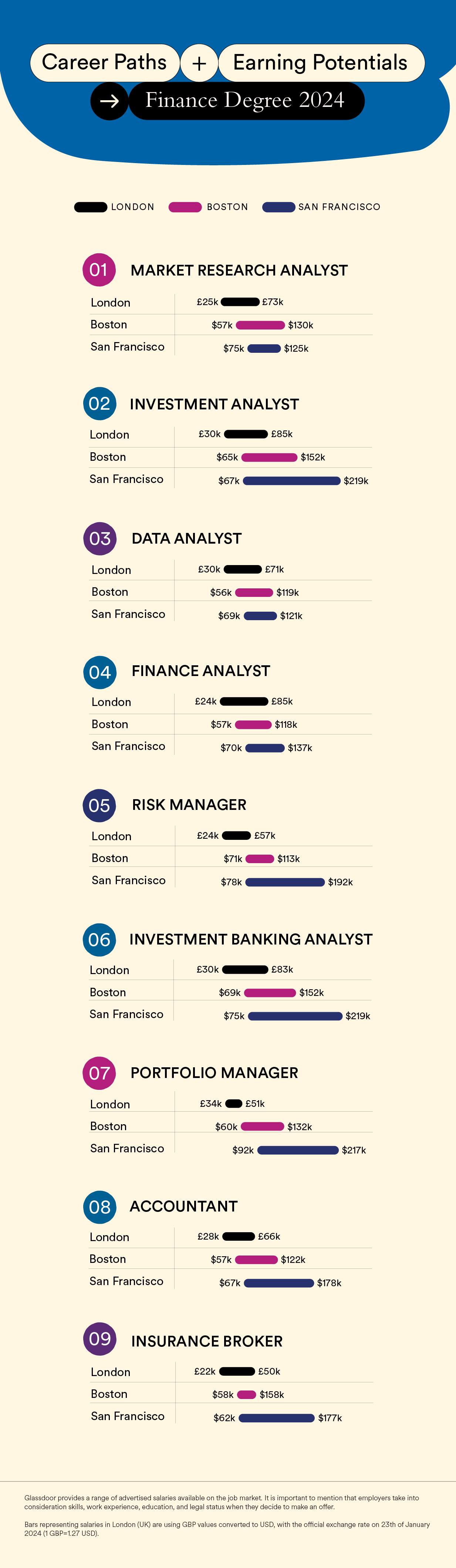

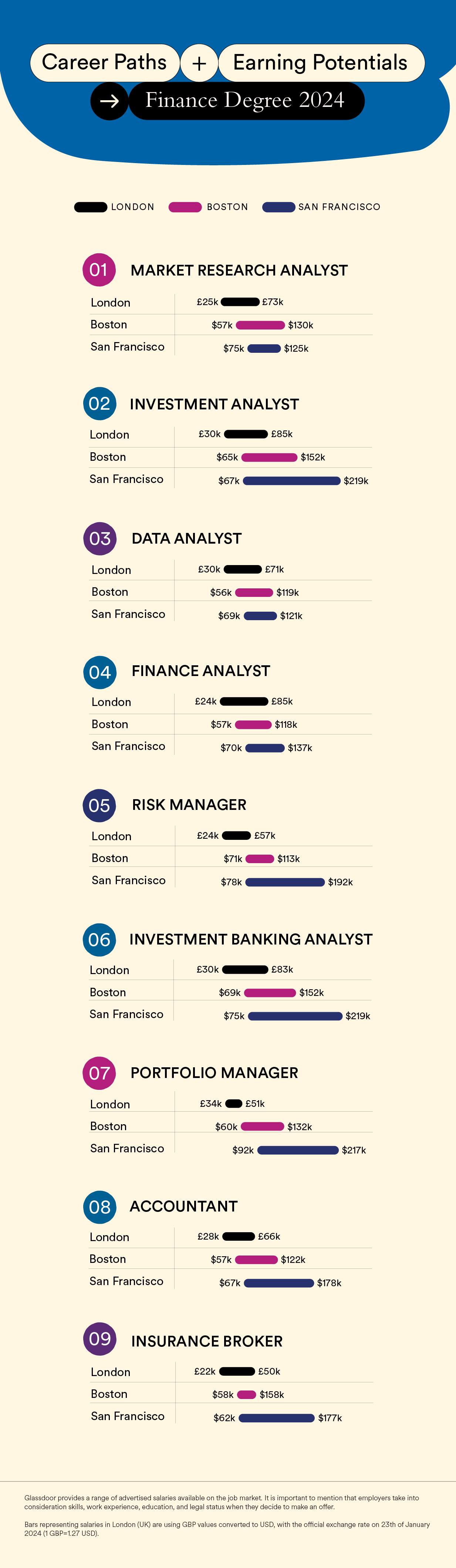

What jobs can I get with a Finance Degree?

Market Research Analyst

If you want a job as a market research analyst, you’re going to need some serious communication and presentation skills. Using them, it’ll be your job to present interpreted data to clients and internal stakeholders that speak to market trends. You’ll get this data through methodologies like surveys, interviews, and tech-based data analysis tools. Your work should inform the broader marketing strategy.

Investment analyst

Similar to a market research analyst, this role means handling lots of data. The key difference this time around is that the data is purely financial. Take a look at stocks, bonds, and commodities—these will be your tools as you identify risks and opportunities. As an investment analyst, the investment strategy going forward is partly your responsibility so make sure you’re up to date with the investment landscape as well as your finance and analysis skills more generally.

Data analyst

The role of a data analyst in any company is to take huge sets of complex information, interpret them, and present them to stakeholders in a way that makes sense. To do that they need to be data-literate, which basically means being accustomed to using multiple data analysis tools to identify correlative patterns that could be significant for their organization. Data is the driving force behind most organizational decisions, so think of them as staff who maximize efficiency in the overall operations.

Finance Analyst

Much like an investment analyst, analyzing investment opportunities is a finance analyst’s bread and butter. The key difference is that a finance analyst also monitors all other financial metrics that could result in new risks or opportunities for the company. Like most analysts, they work with figures of seniority within the company and make recommendations that contribute to growth and broader strategy. Broad knowledge surrounding finance regulations and a head for finance analysis tools are both crucial for success in this role.

Risk Manager

Risk occurs in nearly every facet of business and as a risk manager, you’ll be expected to anticipate and mitigate all of them. These include but aren’t limited to operational, regulatory, and financial risks. You’ll need to adhere to risk management guidelines and maybe implement them if they aren’t already in place. Patterns of risk also need to be monitored so some strong analytical skills will be needed once again for this role.

Investment Banking Analyst

Most roles in investment banking can be highly pressurized jobs and investment banking analyst is no different, so the ability to work under pressure while maintaining a good attention to detail are key skills here. In terms of what you’d be doing on a day-to-day basis, think industry research, valuing companies, and being a key player in due diligence processes. Like other analyst roles, investment banking analysts spend most of their time analyzing financial data presenting it to clients.

Portfolio Manager

To be an effective portfolio manager you must understand the market, its current trends, and its changing conditions. This is because you’ll be tasked with looking after investment portfolios. It doesn’t matter if it’s for an individual or an organization, the client’s goals are your priority, and they’ll trust you to make informed investment decisions on their behalf. Using hard data and market knowledge to manage risk and, most importantly, optimize return.

Accountant

Accountancy could be the perfect role for those with a natural aptitude for math. If you choose to be an accountant, you’ll likely find yourself bookkeeping, processing payroll, doing taxes, and other general financial health checks. It’s your job to ensure that the business you work for is managing its resources in a way that keeps it solvent. There’s plenty of accounting software you’ll be expected to use, so be prepared for that.

Investment Banking, Sales

Investment banking divisions and the clients need a bridge to promote investment opportunities correctly—that’s where investment banking sales professionals come in. For this reason, as well as market knowledge, you’ll also need very strong communication skills. This is because you’ll spend a lot of time articulating financial concepts to clients, as well as connecting them with any other investment opportunities offered by the investment bank.

Financial adviser

Financial advisors exist everywhere across the jobs market—whether it’s helping businesses, individuals, or even families, the ultimate goal of the job remains the same: to secure the financial future of your client. The decisions relating to finance are still down to the individual, so your interpersonal skills need to be exceptional to build a relationship with them. You might be making recommendations on investments, insurance, or even retirement planning, either way, it’s still down to you to ensure your client is making the correct decisions that contribute to their financial goals.

Insurance Broker

Insurance brokers are like matchmakers for insurance companies and their potential clients. Knowledge of the insurance market and of specific insurance providers is integral for this role, as insurance brokers often have to explain policy terms and conditions to clients. They also must ensure the coverage is tailored to their specific needs. Good communication skills are needed as this job is essentially an intermediary between the company and the client.

What are my options?

There are several programs available for studying finance at the undergraduate and graduate levels. Students can choose from bachelor’s degrees, master’s degrees, and MBA programs, each of which offers various levels of specialization and career opportunities. In this section, we will explore each of these programs in detail.

Bachelor’s degree with a major in finance

A bachelor’s degree in finance is a four-year program that provides students with a comprehensive understanding of financial theory, financial analysis, and financial management. It covers various areas such as investments, financial markets, corporate finance, and financial accounting. The program typically includes both theoretical coursework and practical training, such as internships, case studies, and group projects. Graduates can pursue careers in various fields, including investment banking, financial analysis, financial planning, corporate finance, and portfolio management.

Hult Graduate Programs:

Master’s in Finance

A master’s degree in finance is a one-to-two-year program that builds on the foundational knowledge gained during a bachelor’s degree in finance. You will gain a deeper understanding of financial theory and financial analysis and offers more specialized courses depending on your area of interest. You’ll focus more on risk management, financial modeling, and quantitative finance. The program also includes practical training such as internships and case studies so you can learn on the job. Graduates can pursue careers in investment banking, hedge fund management, financial consulting, and risk management.

Find more about what jobs can you get with a Master’s in Finance:

MBA in Finance

An MBA specializing in finance is a one-to-two-year program that provides students with a comprehensive understanding of business management and financial theory. The program covers topics such as financial analysis, corporate finance, investment banking, risk management, and financial planning. It also includes practical training such as internships and case studies. Graduates can pursue careers in various fields, including investment banking, financial consulting, corporate finance, and portfolio management.

Hult Dual Degree in Finance:

Choosing the right program

Choosing the right program depends on several factors, like your career goals, academic background, and personal interests. Students interested in pursuing a career in finance and having a durable foundation in mathematics and accounting may find a bachelor’s degree in finance a good fit. On the other hand, students who want to specialize in a particular area of finance, such as risk management or financial modeling, are probably better suited to a master’s. If the student wants to combine their interests in business management and finance then an MBA specializing in finance is the way to go.

There are plenty of other considerations students should also consider. Like the reputation of the school, the availability of internships and networking opportunities, and the cost of tuition and other expenses. Some schools may offer scholarships, grants, or financial aid to help cover the cost of tuition. It’s all part of the wider whole and will help you pick the right program for a successful career in finance.